Ethena Governance Report: August 2025

Welcome to the latest installment of Ethena’s monthly governance update, covering all major developments in August 2025. This report highlights significant protocol growth, key risk metrics, major ecosystem expansions, and important governance activities.

Key Takeaways

-

The third term of the Risk Committee has begun. It now includes Blockworks Advisory, Credio (Untangled), Ethena Labs Research, Kairos Research, Llama Risk, and Steakhouse Financial.

-

Institutional access: USDe is now available for custody on Coinbase Prime, opening direct access for institutional investors.

-

New eligible backing assets: BNB, XRP, and HYPE approved under the newly introduced Eligible Asset Framework for USDe’s perp hedging collateral.

-

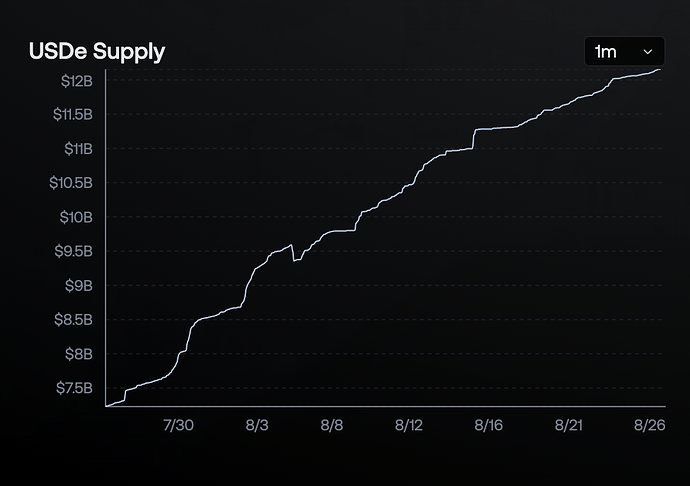

Supply surge: USDe supply increased 43% MoM, from 8.5B to 12.1B.

-

Protocol yield: sUSDe APY at 8.54%, remaining well above benchmarks like Sky Savings Rate (4.75%) and Aave (4-5%).

-

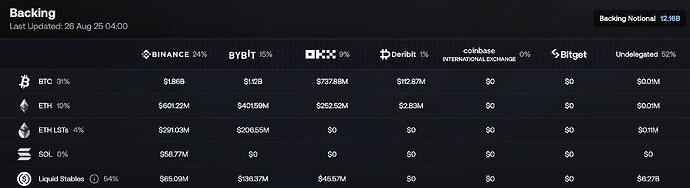

Collateral allocation: 54% in stable backing ($2.9B supplied in Aave), 46% in delta-neutral perps (BTC, ETH, ETH LSTs, SOL).

-

Pendle markets: $4.37B TVL across Ethena-related maturities, with large September 2025 PT expiries approaching.

-

Lending platforms: Strong usage of Ethena assets as collateral on Aave v3 (several caps nearly maxed) and Morpho Blue (multiple active PT markets).

-

Aave exposure review: Ongoing analysis of updated caps to ensure redemption times remain adequate under stress.

-

Morpho framework: Introduced to evaluate USDe/USDTb allocations into Steakhouse-curated vaults, balancing yield vs. risk.

-

Reserve Fund: Currently at $62M, above the recommended range ($41.6M–$57.4M). Proposal approved to consolidate all assets into USDtb, contingent on backing composition.

Ecosystem Updates

Ethena’s ecosystem expanded significantly through several strategic partnerships and integrations.

- USDe is now available for custody on Coinbase Prime, which means institutional investors on Coinbase Prime now have direct access to USDe. Link

- BNB, XRP and HYPE have been approved as eligible candidates backing USDe. The Ethena Risk Committee has established the Eligible Asset Framework, which represents a new approach to widening approved backing assets for the perpetual futures portion of the collateral backing of USDe. Link

- sUSDe live on Aave on Aptos, through Aave’s latest deployment on Aptos. Link

- Season One: Epoch 1 has begun on Ethereal. Pre-deposits are open in anticipation of mainnet integration. Link

- Ethena is now on HyperEVM through Pendle’s integration. Link

- Liquid Leverage was launched. Link

- Users can now deposit 50% sUSDe and 50% USDe into Aave and earn promotional rewards for USDe, in addition to the USDe lending rate and sUSDe’s native APY.

- This new Ethena/Aave integration enables users to take leveraged exposure to sUSDe yields while maintaining greater liquidity across their position through USDe holdings, without a cooldown period.

- Liquid Leverage has seen over $1.5b of inflows in its first week.

- Ethena is live in the TON DeFi Ecosystem, allowing Ethena users to earn up to 20% APY through TON DeFi. Link

Protocol & Risk Metrics

August 2025 was a month of significant growth for Ethena.

Main Protocol Metrics

Protocol backing ratio: 100.61%

Reserve Fund: $61.7M

Total USDe supply: $12.1B

Total backing: $12.17B

USDe supply increased significantly over this month, from ~8.5B to ~12.16B at the time of writing, an increase of 43%.

The peg stability was maintained.

Staked USDe (sUSDe) supply grew significantly to 5.6B USDe, though at a slower pace than overall USDe supply. As a result, the staking ratio declined to 46.32% of total supply, down from 57.26% last month.

Regarding protocol yield, sUSDe currently offers an APY of 8.54%, remaining highly competitive relative to other stablecoin yield options such as the Sky Savings Rate (4.75%) and Aave lending (4–5%).

Fee Switch Metrics

USDe circulating supply: >$6bn

→ currently: $12.10B

Cumulative protocol revenue: >$250m lifetime

→ currently: $453M

CEX adoption: USDe integrated on 4 of top 5 centralized exchanges by derivative volumes

→ currently: 3 of the top 5 (Binance & OKX remain)

sUSDe APY spread vs benchmark rate: between 5.0-7.5% over benchmark rate

→ currently: 4.25%

Collateralization

The protocol’s solvency remains healthy at 100.61% collateralization.

USDe’s stable backing has steadily increased throughout last month, alongside a much more modest increase in perps hedging positions. We’ve seen a 43% MoM increase in USDe supply, and a 71% increase in liquid stable backing, from $3.8B to $6.5B. From this stable backing, a total of $2.9B ($1.5B in USDT, $1.3B in USDC and $100M USDtb) have been deposited into Aave, earning yield through the supply rate. The Risk Committee is currently conducting an in-depth analysis to determine appropriate caps on the share of USDe backing that can be allocated to Aave.

The remaining 46% of USDe’s backing is allocated to delta-neutral positions. These include 31% in BTC, 10% in ETH, 4% in ETH LSTs, and <1% in SOL. On the venue front, Ethena’s active hedging positions are currently concentrated across four centralized exchanges: Binance, Bybit, OKX, and Deribit, with no exposure to Bitget or Coinbase INTX at this time.

Liquidity

Liquidity expanded from ~$155M to $240M this month, a 55% increase, broadly in line with USDe supply growth. The biggest increase was seen on Fluid, particularly in the USDT–USDe pair.

DeFi Integrations

Ethena assets continue to see deeper adoption as collateral across major DeFi markets.

Pendle Markets & Upcoming Maturities

- Total TVL in Ethena-related Pendle markets: $4.37B

- Key upcoming maturities:

- PT-sUSDe-25SEP2025: $2.95B TVL

- PT-USDe-25SEP2025: $3.92B TVL

Collateral on Lending Platforms

- Aave v3: Ethena assets are widely utilized as collateral, with several markets nearing their supply caps:

- USDe: $1.42B / $1.80B cap

- sUSDe: $950M / $1.3B cap

- PT-USDe-25SEP2025: $1.8B / $1.8B cap (full)

- PT-sUSDe-25SEP2025: $2.38B / $2.38B cap (full)

- Morpho Blue: Multiple Ethena-related PT markets are live with meaningful liquidity:

- PT-USDe-25SEP2025 / USDC: $281.6M

- PT-USDe-25SEP2025 / DAI: $200M

- PT-USDe-25SEP2025 / USDT: $41.7M

- PT-sUSDe-25SEP2025 / DAI: $40.4M

- Additional smaller markets also active.

Governance Updates

Risk Committee – Third Term

The third term of the Risk Committee began this month. The committee now includes Kairos Research (new), alongside reelected members Blockworks Advisory, Credio (by Untangled), Ethena Labs Research, Llama Risk, and Steakhouse Financial.

All members underwent thorough background screening and KYB verification to ensure compliance with Ethena’s governance standards. Reelected members also completed a KYB refresh to maintain consistent oversight.

Updated Caps for Aave Integration

The Risk Committee has kicked off an in-depth analysis of updated caps for USDe backing on Aave. The review will focus on maintaining adequate redemption times under stress scenarios and ensuring the integration remains sustainable as exposure grows.

Backing Asset Framework – New Eligible Assets

The Committee introduced a formal framework for onboarding new perpetual futures as backing assets for USDe. Candidates must meet strict thresholds on open interest, liquidity, funding rates, and asset maturity before being approved.

The first assets to qualify under this framework are XRP, HYPE, and BNB, which have now been deemed eligible for onboarding.

Lending on Morpho – Risk Framework

The Committee developed a quantitative framework to evaluate allocations of USDTb and USDT from USDe’s backing into Morpho vaults, focusing on Steakhouse-curated vaults that leverage Ethena-native assets (USDe, sUSDe, PTs) as collateral.

The framework balances yield opportunities with liquidity, operational, protocol, and curator risks, informed by both on-chain activity and historical data.

Reserve Fund – Monthly Update

The latest monthly Reserve Fund update sets the recommended size between $41.6M–$57.4M. With ~$62M currently held, the fund remains well capitalized, and no additional contributions are required at this time.

Reserve Fund – Consolidation into USDtb

The Subcommittee has approved a proposal to consolidate all Reserve Fund assets into USDtb, contingent on the condition that USDC/USDT in USDtb’s backing consistently exceeds the Reserve Fund balance.