Ethena Monthly Reserve Fund Recommendations: August

Summary

This analysis is presented by LlamaRisk and Blockworks Advisory, members of the Risk Committee leading risk recommendations on the Reserve Fund. We will periodically re-evaluate the fund’s size based on market conditions, changes in USDe’s backing, and projected capital needs, with the previous monthly update published here.

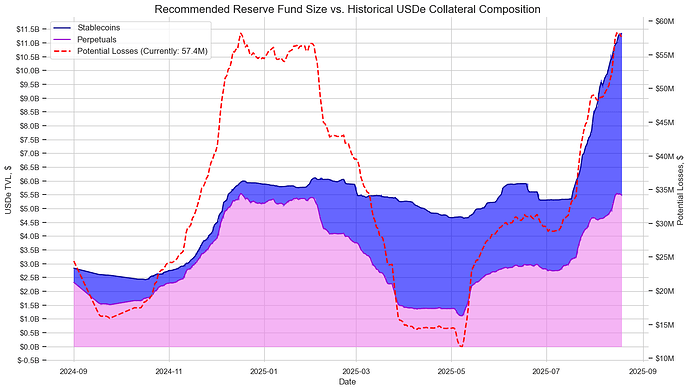

The overall situation over the past weeks was very positive such that USDe supply grew to ~$11.5B, beating previous growth estimates and primarily fueled by continued positive market conditions.

LlamaRisk’s methodology suggests a need for $57.4M on the conservative scenario and $41.6M on the moderate side, while Blockworks Advisory recommends $52.3M. What led the recommended capital not to surpass the current fund size (~$62M) is the fact that Ethena did not allocate incremental backing to perpetual futures positions. The growing share of USDe backing on Aave is being monitored, and an in-depth analysis of this integration will determine whether adjustments are needed to the current reserve fund sizing methodologies to properly account for this shift in USDe’s backing.

Therefore, the current fund is sufficient to support the current USDe supply. We will conduct more continuous internal reviews to ensure this insurance buffer remains adequate for USDe’s continued stability.

Additionally, the Reserve Fund Subcommittee has reviewed and accepted a proposal to consolidate all Reserve Fund assets into USDtb, contingent on the USDC/USDT held in USDtb’s backing consistently exceeding the size of the Reserve Fund.

LlamaRisk Methodology & Estimations

Utilizing the Reserve Fund drawdown methodology developed by LlamaRisk, which considers current and historical market conditions, USDe collateral distribution, stablecoin buffer, and sUSDe supply, we present up-to-date drawdown simulations to estimate current Reserve Fund capitalization needs.

Conservative Scenario

In this scenario, according to the methodology, we assume all perpetual positions would need to be closed within a 24-hour time span, incurring 50 bps in negative funding rate losses and 50 bps in slippage losses. From this, we derive the following estimate for the required Reserve Fund size:

Source: Reserve Fund Drawdown Methodology V2, August 19th, 2025

Simulating this short-term risk scenario results in a recommended Reserve Fund size estimation of $57.4 million. With this Reserve Fund size, Ethena would remain solvent and be able to serve all USDe redemptions, even under the worst tail-risk scenario that would require closing all perpetual positions in a short time frame.

Moderate Scenario

The moderate scenario assumes that a decline in funding rates would trigger a significant amount of sUSDe to enter the unstaking queue, leading to a potential wave of USDe redemptions. The maximum amount of USDe is based on the current circulating supply and the assumption that USDe in liquidity pools will not be redeemed. It is also assumed that Ethena will prioritize timely redemptions to prevent the USDe price from de-pegging, using its stablecoin buffer for instant redemptions and closing perpetual positions for the rest. Additionally, the scenario assumes that redemptions requiring the closure of perpetual positions will be managed with slippage capped at 75 basis points and funding rate losses limited to 5 basis points, while any remaining positions could face up to 50 basis points in funding losses before being gradually wound down with lower slippage.

Source: Reserve Fund Drawdown Methodology V2, August 19th, 2025

This scenario results in a currently recommended Reserve Fund size of $41.6 million. With this Reserve Fund size, Ethena could successfully serve all redemptions of circulating USDe while being able to wind down perpetual positions more gradually and over a larger time frame, assuming funding rates are milder than in a tail-risk scenario. This moderate recommendation is supported by the fact that Ethena currently keeps an expanded stable, highly liquid asset buffer in USDe backing.

Blockworks Advisory Methodology & Estimations

Assuming a highly conservative scenario where Ethena chooses to unwind all perps positions within 24 hours during a severe market downturn, the Reserve Fund needs to cover two key costs: negative funding rates during that window and slippage from exiting positions. Note that the likelihood of requiring 100% position closure in 24 hours is very low and this scenario addresses a worst-case possibility in terms of funding rates.

To estimate funding costs, we can use a dynamic model that builds on the approach of looking at the share of backing in perpetuals by also factoring in the specific assets and venues involved, allowing for a nuanced assessment. The model considers the most extreme historical funding events, specifically the worst 0.1% of datapoints for each asset and exchange pair, and applies those rates to Ethena’s current allocation to estimate potential funding cost exposure under stress. This becomes especially important as more volatile collateral assets like SOL are added, and as certain venues prove better equipped than others to handle extreme market conditions. The same total allocation can carry very different risk profiles depending on where and how it’s deployed, which in turn affects the size needed for the Reserve Fund.

Slippage is the second major cost, incurred both when closing short positions and selling spot. We estimate this at 50bps in a worst-case scenario, which was the maximum slippage observed by Ethena when trading ETH perpetual futures during the recent Bybit hack.

Current Estimation and Historical Context

Based on this methodology, the Reserve Fund would today need to currently hold approximately $52.3M to be sufficiently capitalized. At this level, Ethena would be able to fully unwind its current positions even under historically extreme negative funding conditions, while maintaining solvency throughout.

To put this into perspective, consider the estimated Reserve Fund requirement as a percentage of total backing. It highlights how the composition of assets can significantly influence the appropriate size of the Reserve Fund, even proportionally to total backing. While current estimates suggest that the Reserve Fund’s needs are below its current capitalization, it’s important to note that Ethena is expected to act swiftly to capture the highest yields available.

Recommendation

According to the consensus of recommendations, the current Reserve Fund size is sufficient to cover potential drawdowns as outlined in our modeled scenarios. This means that no immediate capitalization increases are needed for the Reserve Fund.

While no new allocations are needed at this time, upon additional allocations to perpetual futures, this buffer can be quickly exhausted. We will continuously monitor the backing dynamics to recommend Reserve Fund increases when needed.

Reserve Fund Composition

The Reserve Fund is currently composed of the following assets:

- Wallet

- $19,710,412 USDtb

- $5,319,310 USTB

- Curve USDtb–USDC pool: $19,995,255

- $9,433,492.9619 USDC

- $10,563,258.3796 USDtb

- sUSDS: $14,328,881

All of these positions generate broadly similar yields for Ethena. To streamline management, the Reserve Fund Subcommittee has been asked to evaluate a proposal to consolidate the Reserve Fund fully into USDtb.

Risk Considerations

Two risks primarily guide the composition of the Reserve Fund: liquidity and third-party exposure. Because the Reserve Fund exists to ensure USDe remains fully collateralized, even under stress, it must be:

- Highly liquid

- Immediately accessible

- Isolated from contagion channels during extreme events

Accordingly, the Reserve Fund’s risk assessment focuses on the underlying assets of USDtb and the mechanics of its redemption process.

USDtb offers two redemption paths: instantaneous and rapid.

- Instantaneous liquidity: $7.93M currently sits in minting/redemption contracts, redeemable immediately.

- Rapid liquidity: The remaining 99.45% is redeemable within 24 hours. Importantly, ~$340M of USDC and USDT backing USDtb is custodied and transferable within a few blocks, 24/7/365, using the same redemption mechanics as USDe.

This means the pool of USDC immediately available for redemption far exceeds the size of the Reserve Fund itself. On this basis, the Subcommittee is comfortable consolidating the Reserve Fund entirely into USDtb, provided that the USDC/USDT held within USDtb’s backing consistently exceeds the Reserve Fund balance.

This structure ensures that liquidation of the Reserve Fund into USDC/USDT can be executed directly and independently by Ethena, without reliance on BUIDL honoring fast redemption requests.