Ethena Governance Report: July 2025

Welcome to the latest installment of Ethena’s monthly governance update, covering all major developments in July 2025. This report highlights significant protocol growth, key risk metrics, major ecosystem expansions, and important governance activities.

Key Takeaways

- Ethena experienced substantial growth, with the USDe supply increasing by over 30% to surpass $7.6 billion. The protocol’s yield remains highly competitive in comparison with the broader market, with sUSDe APY standing at 9.82%.

- StablecoinX Inc. announced a $360 million capital raise with plans to list on Nasdaq under the ticker “USDE”. The move aims to provide direct equity market exposure to Ethena’s ecosystem, with proceeds used to acquire ENA from the Ethena Foundation.

- The Risk Committee approved the integration of Coinbase International Exchange (INTX) as a new hedging venue, diversifying liquidity sources. Meanwhile, Ethena assets (PTs, USDe, sUSDe) have expanded their footprint as collateral across major lending platforms like Aave and Morpho, with total supplied value reaching hundreds of millions.

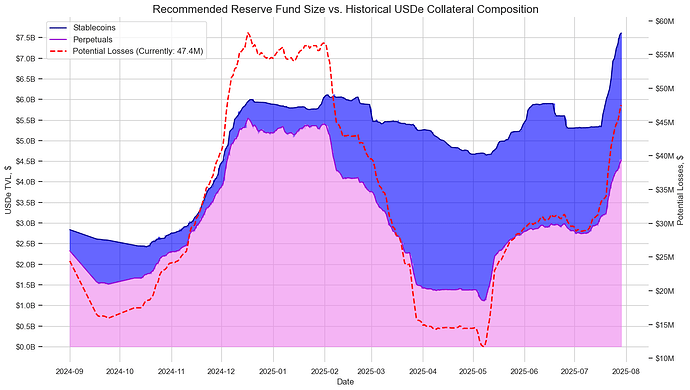

- The protocol remains robustly over-collateralized at ~100.9%. The Reserve Fund is stable at $61.2 million, and risk analysis indicates it is sufficiently capitalized to handle market volatility and near-term growth. On-chain data shows strong user conviction, with minimal sUSDe unstaking events and low USDe redemptions.

- The Ethena Foundation announced the key dates for its Third Term Risk Committee Elections, reinforcing its commitment to decentralized oversight. The Reserve Fund subcommittee also published its monthly update, confirming the fund’s adequacy.

Protocol & Risk Metrics

July was a month of significant growth and stability for the Ethena protocol.

- Supply and Yield:

- USDe: The total supply of USDe grew to $7.602 billion, a 30.28% increase over the last month. This was driven by several large daily mint events, indicating strong demand. The peg stability of the stablecoin is robust, with the DEX liquidity being at stable levels (~$86M).

- sUSDe: The supply of staked USDe (sUSDe) reached $4.352 billion, with the staking ratio growing to 57.26% of the total USDe supply.

- Protocol Yield: The sUSDe APY is currently 9.82%, continuing to offer a competitive yield compared to other stablecoin yield opportunities like the Sky Savings Rate (4.5%) and Aave lending (3-4%).

Source: Ethena Risk Portal, July 29th, 2025

Source: Ethena Risk Portal, July 29th, 2025

Source: Ethena Risk Portal, July 29th, 2025

Source: Dune Analytics, July 29th, 2025

- Risk & Resilience Metrics:

- Redemptions & Unlocks: The protocol saw very low redemption pressure, where mint events far outpaced redemptions. Furthermore, there were minimal sUSDe unlock events, signaling high holder confidence.

- Collateral & Solvency: The protocol’s solvency remains healthy at 100.92%. The stablecoin buffer has risen to $3.11 billion, providing a substantial cushion. The redemption buffer, available for instant redemptions, stands at $46 million, composed of USDT, USDC, and USDtb.

- Reserve Fund: The Reserve Fund capitalization is $61.2 million. The latest analysis from LlamaRisk as of July 29th 2025 confirms this amount is sufficient to cover potential drawdowns under current market conditions.

Source: Ethena Risk Portal, July 29th, 2025

Source: Ethena Risk Portal, July 29th, 2025

- Fee Switch Metrics Update:

The protocol’s performance against the fee switch activation thresholds is as follows:- USDe Circulating Supply: $7.6B (Threshold: >$6B) - MET

- Cumulative Protocol Revenue: $430M (Threshold: >$250M) - MET

- CEX Adoption: 3 of the top 5 CEX by derivatives volume (Threshold: 4) - NOT YET MET

- sUSDe APY Spread vs Benchmark: 5-6% (Threshold: 5.0-7.5%) - MET

Ecosystem Expansion & Integrations

Ethena’s ecosystem expanded significantly through several strategic partnerships and integrations.

StablecoinX Inc. to List on Nasdaq, Backed by ENA

StablecoinX Inc. announced a $360 million capital raise and its intent to list on the Nasdaq Global Market under the ticker “USDE”. The company will use the proceeds to acquire locked ENA from an Ethena Foundation subsidiary, giving equity investors direct exposure to the Ethena ecosystem. The Foundation will, in turn, use the cash proceeds to strategically purchase ENA on the open market over the next six weeks.

Coinbase International Exchange (INTX) Integration

Following approval from the Risk Committee, Ethena has onboarded Coinbase International Exchange (INTX) as a new hedging venue via Copper’s ClearLoop. With INTX’s open interest recently surpassing $1 billion, this integration provides a significant new surface of liquidity to diversify the hedging of USDe’s backing assets.

Anchorage Digital Partnership for USDtb

Anchorage Digital and Ethena have formed a strategic partnership to bring USDtb to the U.S. market, establishing a pathway for the token to become compliant with the recently enacted GENIUS Act.

Strata Money Pre-Deposit Campaign

The Ethena-powered structured products protocol, Strata, went live with its pre-deposit campaign. Users can deposit USDe and eUSDe to earn Ethena rewards and Strata points. Staked ENA (sENA) is also eligible for a share of Strata’s future token supply.

Collateral & DeFi Footprint

Ethena’s assets are becoming increasingly integrated as collateral across the DeFi ecosystem.

-

Pendle Markets & Upcoming Maturities:

The total value locked (TVL) in Ethena-related Pendle markets stands at $4.37 billion. Key upcoming maturities for Principal Tokens (PTs) include:- PT-sUSDe-31JUL2025: $1.64B TVL

- PT-USDe-31JUL2025: $375.37M TVL

- PT-eUSDe-14AUG2025: $743.72M TVL

-

Collateral on Lending Platforms:

-

Aave: Ethena assets are actively used as collateral on Aave v3.

- USDe: $695.5M supplied against a $960M cap.

- sUSDe: $104.27MM supplied against a $500M cap.

- PT-USDe-31JUL2025: $329.85M against a $349.86M cap.

- PT-sUSDe-31JUL2025: $1.16B supplied against a $1.6B cap.

- PT-eUSDe-14AUG2025: $597.7M supplied against a $600M cap.

- PT-sUSDe-25SEP2025: $986.26M supplied against a $986.26M cap.

-

Morpho: Multiple Ethena-related assets are available as collateral on Morpho Blue.

- PT-sUSDe-31JUL2025 / DAI: $10.82M market size.

- PT-sUSDe-25SEP2025 / DAI: $5.36M market size.

- sUSDe / DAI: $4.6M market size.

- PT-sUSDe-31JUL2025 / USDC: $5.3M market size.

with more smaller-sized markets also being live.

-

Governance Activity

-

Approval of Coinbase INTX as Hedging Venue:

As mentioned, the Ethena Risk Committee formally approved the integration with Coinbase International Exchange (INTX) via Copper ClearLoop. This decision diversifies counterparty risk and enhances the protocol’s hedging capabilities. -

Reserve Fund Subcommittee July 14th 2025 Update:

The subcommittee, led by LlamaRisk and Blockworks Advisory, published its monthly analysis. Key findings include:- The Reserve Fund holds $61.2 million.

- Projected capital needs range from $36.2 million (LlamaRisk model) to $43.0 million (Blockworks model).

- The current fund size is deemed sufficient to support near-term growth and maintain USDe’s stability.

After refining the methodology to incorporate more precise slippage data, the current simulations (as of July 29th 2025) suggest that the reserve fund is still adequately capitalized with projected capital needs standing at $47.4M under a conservative scenario.

Source: LlamaRisk, July 29th, 2025

- Ethena Foundation Risk Committee Third Term Elections:

The Foundation has announced the timeline for its next Risk Committee elections to ensure continued robust and decentralized risk management.- Submission Period: July 16 - July 25, 2025

- Shortlisting: Completed by July 28, 2025

- Voting Period: July 28 - August 3, 2025