Introduction

The Ethena Risk Committee presents the Eligible Asset Framework, which represents a new approach to eligible backing assets specifically for the perpetual futures portion of the backing of USDe. The Committee will establish a formalized framework for eligible assets, setting minimums (necessary but not sufficient conditions) for certain metrics such as open interest that assets must surpass before being approved as eligible assets for hedging purposes.

The Committee will provide regular updates on assets that meet this criteria and are approved from a risk perspective as eligible backing assets.

The first batch of assets approved under the new framework are presented in the Implementation section at the end of this post.

Table of Contents

Open Interest

OI Distribution

Liquidity

Funding Rates

Asset Maturity

Appendix: Implementation Guidance

1. Alternative OI threshold

2. Data requirement

3. Monitoring metrics

4. Example

5. Implementation: Token Filtering Framework

Framework

Open Interest

Definition: Total open interest in perpetual futures contracts for the asset across supported exchanges (e.g., Binance, Bybit, OKX).

Minimum Threshold: $1 billion in aggregate OI to ensure sufficient market depth for hedging.

Rationale: High OI ensures Ethena can enter and exit positions without significant slippage.

OI Distribution

We aim to emphasize the importance of OI concentration across exchanges. Even if the total OI threshold is met, an evenly distributed OI across venues may reduce execution efficiency, making it harder for the trading team to deploy meaningful positions.

- Initial proposed value: At least 30% of the total OI threshold should be available on a single onboarded hedging venue (e.g., ~$0.5B based on the current threshold).

Liquidity

Definition: Liquidity is assessed for both spot and perpetual futures markets on supported exchanges. Key metrics include bid-ask spreads, order book depth (within 1% of mid-price), and 24-hour trading volume. Ethena uses relative thresholds based on maximum intended position size on each venue. Each exchange’s liquidity profile can be analyzed and benchmarked for execution before Ethena onboards the venue or asset.

Minimum Thresholds: Ethena determines a “maximum position size” for the asset on each supported exchange. The liquidity requirements are then set in proportion to this position size, P:

Spot and Futures Markets:

-

Bid-ask spread: <0.1% during normal market conditions.

-

Order book depth: A rule of thumb is depth of 2–3 times Ethena’s position within ±1% of the price. For example, if Ethena plans to hold a $10 million spot position in the asset, there should consistently be at least $20–30 million of combined bids and asks within 1% of the mid-price on the primary exchange.

-

24-hour trading volume: the asset’s average daily volume should be a multiple of Ethena’s position to allow easy entry and exit: daily spot volume ≥ 5–10 × P (5–10 times the position). For instance, with a $10 million position, at least $50–100 million in daily spot volume is expected. This ensures Ethena’s position would only account for at most 10–20% of one day’s volume, allowing an exit over a day or two without dominating market activity.

Rationale:

Both spot and perp liquidity are critical to maintaining delta neutrality. If either the spot or futures leg is illiquid, Ethena could face execution delays or large slippage when rebalancing or unwinding positions, which would undermine the strategy. Relative liquidity thresholds tied to position size:

-

It can acquire and dispose of the underlying asset efficiently for the spot leg.

-

It can establish and adjust the hedge on perp exchanges without excessive slippage. High perp volume and depth allow for quick shorting or covering of shorts.

-

The thresholds scale with Ethena’s exposure: if Ethena aims to hold a larger position, the asset must correspondingly have a more liquid market.

Funding Rates

Definition: Funding rates for perpetual futures, measured as annualized rates over rolling 1-month, 3-month, and 6-month periods. Emphasis is on stability and predictability over time, assessed both in aggregate and per venue used for hedging.

Monitoring Thresholds:

Funding Rate Sign Flips: Track the frequency with which funding changes sign (positive ↔ negative) over 8-hour intervals.

-

Trigger: Sign flips exceed 20% of periods over a rolling 3-month window → flag as unstable.

-

Action: If structural negative funding emerges on a venue (e.g., funding < 0% annualized for >7 consecutive days), reduce or fully unwind positions on that venue.

Funding Rate Persistence: Calculate 1-day lag autocorrelation of funding rates.

-

Trigger: Autocorrelation falls below 0.6 → indicates low persistence and higher volatility in funding trends.

-

Action: If low persistence, reduce position sizing in that asset, diversify hedge across more venues, or shorten hedge duration.

Cross-Exchange Spreads: Monitor differences in funding between venues.

-

Trigger: Spread > 3% annualized between major venues for the same asset → assess for arbitrage potential or rebalancing between venues.

-

Action: If cross-venue spreads persist, rebalance positions to optimize funding capture while maintaining net delta-neutral exposure.

Rationale:

The objective is to identify when funding is structurally adverse or unstable so that positions can be resized, re-balanced, or migrated between venues.

-

Predictability reduces operational churn: stable funding allows longer holding periods without frequent re-hedging.

-

Venue-specific monitoring captures situations where only one exchange shows negative or unstable funding, enabling tactical reallocation.

-

Trigger-based management ensures that funding instability translates into concrete portfolio actions.

Asset Maturity

Definition: Length of time the asset’s perpetual futures market has been active and stable.

Minimum Threshold: >12 months of continuous trading with OI >$500 million.

Rationale: A mature market reduces risks associated with untested contracts or low liquidity.

Appendix: Implementation guidance

Alternative Threshold (Dynamic): As an alternative to the static $1 billion threshold, Ethena may apply a dynamic OI threshold tied to its Total Value Locked (TVL). For example, a minimum requirement of 20% of TVL ensures that backing assets scale appropriately with the protocol’s growth.

To contextualize this, SOL, which currently comprises only ~1% of Ethena’s backing, can serve as a reference point. As of now:

-

SOL’s combined open interest across all Ethena-supported hedging venues is approximately $5.2 billion (source: Coinglass), representing ~70% of current Ethena TVL.

-

On Binance — the only venue where Ethena currently holds SOL-backed perp positions — SOL’s OI stands at $1.95 billion, or roughly 26% of TVL.

Setting the dynamic OI threshold significantly below SOL’s current market footprint would likely present minimal growth potential, especially when not supported by other favorable metrics (e.g., stable funding rates).

For illustration: with a TVL of $7.5 billion, a 20% dynamic OI threshold implies a minimum required OI of $1.5 billion.

| Metric | Description |

|---|---|

| Open Interest (OI) | Total OI in perpetual futures contracts from listing date (USD) |

| Bid-ask spread (spot) | Daily average spread (%) |

| Order book depth (spot) | Daily average depth within 1% of mid-price (USD) |

| 24-hour trading volume | Daily volume (USD) |

| Bid-ask spread (perp) | Daily average spread (%) |

| Order book depth (perp) | Daily average depth within 1% of mid-price (USD) |

| 24-hour trading volume (perp) | Daily volume (USD) |

3. Monitoring metrics

4. Example

5. Implementation: Token Filtering Framework

Data Source

Provider: Coinglass Open API

Exchanges: Binance, Bybit, OKX

Cut-off date: 16 Aug 2025

Note: To obtain comprehensive data, we need to collect it from all centralized exchanges as well as decentralized exchanges. However, in the following experiment, we use data from 6 tokens XRP, SUI, HYPE, ADA, BNB, across 3 centralized exchanges: Binance, Bybit, OKX. In addition, since the Hype token from Hyperliquid has its liquidity concentrated on the Hyperliquid DEX, we also included data from Hyperliquid specifically for this token.

Metrics & Definitions

-

Daily Average Open Interest (2 weeks) Average USD open interest over the last 14 days across selected exchanges.

-

Spot Trading Volume (24h average, 1 week) Average 24h spot trading volume over the last 7 days.

-

Perpetual Trading Volume (24h average) Current 24h perpetual contract trading volume.

-

Spot Market Depth (1% bid + ask, 2 weeks) Average liquidity within 1% of mid-price (bid + ask) over the last 14 days.

-

Perpetual Market Depth (1% bid + ask, 2 weeks) Same as above, but for perpetual contracts.

-

Funding Rate Dynamics (30 days, 8h periods)

Funding Flips: number of times the funding rate crosses zero.

Funding Rate 1-period Autocorrelation: persistence of funding sign/level across epochs.

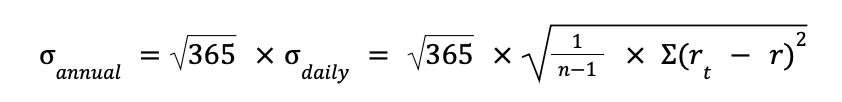

- Spot Price Volatility (30d annualized)

Annualized volatility from 30 days of log returns.

- 5th Percentile Open Interest (min of last 180 days)

5% quantile of open interest across exchanges, capped by listing history.

Thresholds for Onboarding

Avg OI (2w): > 1B USD

Spot Volume (24h avg, 1w): > 100M USD

Perp Volume (24h): > 100M USD

Spot Depth (1%, 2w avg): > 0.5M USD

Perp Depth (1%, 2w avg): > 10M USD

5% percentile minimum OI (180d min): > 300M USD

Results

- Passed: XRP, HYPE, BNB meet all thresholds → candidates for onboarding.

- Rejected: SUI, ADA fail key liquidity and OI requirements despite decent correlation/volatility.

More detail: [Ethena] Onboard backing assets, we can up/down the threshold (blue cell) to see the onboard result.