Summary

This proposal outlines a suggested mechanic whereby:

-

Ethena currently has $5bn of stablecoins in the backing of USDe, most of which are readily available and liquid to meet redemption requirements at any given time.

-

USDe may be purchased with USDT (or other stablecoins) held in the backing of USDe (as a substitute for normal redemption flows) in order to support orderly secondary market liquidity and operations during abnormal market dislocations.

-

The effective impact would be identical to a normal USDe burn for USDT (or another stablecoin) redemption, except that the “redemption” would be made for under $1 of backing assets.

-

The purchases would be executed via bids placed on centralized exchange orderbooks, up to a specified capped size and only below a price threshold, using off-exchange solutions (i.e., no backing assets would be deposited to exchanges directly).

-

The proposed amount earmarked for this mechanic would be 1.2% of USDe’s total backing assets, which would equate to ~$95m based on the current USDe supply.

-

The initial proposed threshold at which bids would be placed would be at a price of 0.99 or lower.

-

USDe acquired via this mechanic would be immediately burned following trade settlement. The net result is an equal reduction in assets and liabilities, outside of the incremental assets generated purchasing USDe below $1.

-

When gas fees spike on Ethereum mainnet, as they did on Friday 10th October, many market makers’ operations are severely impacted and as a result they decide not to arbitrage on exchanges until gas cools down, exacerbating any liquidity issues on secondary markets in times of stress.

-

Due to the spread captured in a scenario where USDe market price has dislocated from redemption value, Ethena is able to bear the cost of gas in volatile markets.

-

An ad-hoc Proof of Reserve would be provided within 24hrs of any use of this mechanic.

-

For absolute clarity, this is intended for use only in severe market dislocations, as defined by USDe price trading below 0.99, and is not intended for every day use.

The net impact of the transaction would be increasing the collateralization ratio of USDe, reducing the USDe supply, and supporting the secondary market USDe price - with excess USDT (or other stablecoins) captured being used as reserves.

Background

On the evening of October 10th, the USDe/USDT pair on Binance began to depeg past 0.990 and hit as low as 0.6567 minutes later, resulting in a significant haircut to Binance users’ USDe collateral value and likely playing a part in the liquidation events seen on Binance during the market volatility.

Unlike Bybit, Binance did not integrate direct mint/redeem functionality for USDe on its platform. As a result, liquidations and sell orders of USDe on Binance were directed to the USDe/USDT orderbook instead of directly redeeming with Ethena.

It was reported that trading firms were unable to withdraw or deposit inventory from Binance for prolonged periods of time, which greatly exacerbated the issue. This had a significant impact on the USDe price in the Binance USDe/USDT spot order book and apparently resulted in a cyclical loop of USDe liquidations → USDe depeg → more liquidations.

For reference, Bybit’s USDe/USDT pair only depegged to a low of approximately 0.9408, despite Bybit also greatly slowing the pace of deposits & withdrawals for users.

Meanwhile, USDe pricing on DEXs was remarkably stable, with Curve’s USDe/USDC pair only briefly dipping to 0.997.

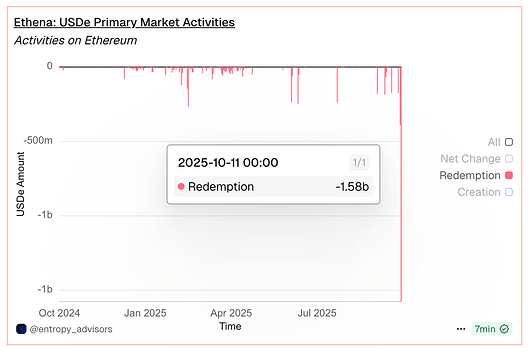

Ethena’s primary mint/redeem facility with whitelisted parties functioned without any issues throughout the volatility, servicing over $2bn worth of instant USDe redemptions in a 24hr period.

In this scenario, anyone that was able to bid USDe price below $1 was able to capture a spread by subsequently redeeming USDe with Ethena for $1 of USDT/C. However, due to the apparent Binance exchange issues noted above market makers weren’t able to step in and defend the USDe peg on Binance, with 2% bid depth dipping as low as $6m during the crash.

If adequate size was able to be placed on the bid side for USDe, the secondary price would not have dislocated so severely on Binance specifically in a scenario where Ethena was fully solvent and operating as normal and true redemption value for USDe was not impaired.

Additional last-resort acquisitions and burns of USDe at a discount would have reduced the idiosyncratic price impact on Binance while capturing a benefit to Ethena, a net benefit for the protocol overall.

Next Steps

Risk Committee members have been notified of this proposal in advance and will post their recommendations in the comments below this post. Should the proposal receive approval from the Risk Committee, Ethena will have the ability to purchase discounted USDe on secondary markets using backing assets, which will be immediately burned following trade settlement. This is intended for use only in severe market dislocations, as defined by USDe price trading below 0.99, and an ad hoc Proof of Reserve will be provided within 24hrs of using this mechanic.