Introduction

Following up on this proposal — as well as the proposal regarding Ethena supplying USDtb to Aave — Blockworks Advisory conducted a detailed risk analysis on the broader integration of Aave into USDe’s backing framework.

The full report can be found here.

Key Points: Risks & Recommendations

- Cap Capital Supply to Mitigate Multi-Faceted Risks: Limit the aUSDT and aUSDC supply on Aave to between 5% and 10% of their total aUSDT and aUSDC supply combined (which would currently translate to between $313.5M and $627M). This restricts exposure to redemption, token-specific, insolvency, and governance risks while also managing the inverse relationship between yield and available exit liquidity.

- Set a Minimum Yield Threshold: Ensure that any deployed capital in USDC and USDT markets earns at least a 25 basis points premium over the higher of either the risk-minimized rate (approximately 4.5%) or the risk-free rate (about 4.4%).

- Adopt an Active Management Strategy: Rather than maintaining passive positions, dynamically manage the supplied capital based on the highest yield available. Monitor the exit liquidity and withdraw capital when the market hits an exit liquidity of 1.25 times the supplied capital, thereby protecting against adverse liquidity shifts.

- Aave Backing Collateral Cap: Ethena should limit its allocation of stablecoin backing to Aave to at most 10% of the total stablecoin backing (which would currently be $332M).

- Control Looping by Retaining a Predominant Stake: To mitigate the risk that looped USDtb positions could indirectly dominate sUSDe supply (which should stay below 10% of the sUSDe total supply), Ethena should initially supply at least 50% of the USDtb market’s total supply. The market’s total supply cap should start with a conservative market supply cap of around $40M to minimize risks, which is in line with historical initial caps on Aave.

Onboarding Aave’s aUSDC and aUSDT as USDe Backing Assets

To recap, the proposal seeks to onboard aUSDC and aUSDT as backing assets for USDe because they offer a higher yield compared to both the risk-minimized rate provided by sUSDS (currently at 4.5%) and the risk-free rate offered by US3M (4.41%), currently being captured through the USDtb portion of USDe backing; additionally, it presumes that if interest rates on T-Bills are likely to be cut next year, aUSDC and aUSDT could be compelling backing asset options.

Research Questions

- Yield Analysis: Do the yields for both USDC & USDT markets on Aave regularly underperform, track, or overperform current sUSDS / US3M rates?

- Token-Specific Risk: How does peg stability of USDC & USDT affect supplying collateral to those markets on Aave?

- Redemption Requests: What risk is associated with redemption requests for USDC & USDT markets on Aave?

- Market Insolvency: What is the risk of bad debt in USDT & USDC markets on Aave?

- Governance Risks: What are the Aave DAO governance risks incurred by supplying liquidity on Aave to USDC & USDT markets?

- Expected Returns: What are the expected returns for supplying capital to USDC & USDT markets in a bear and bull scenario on Aave?

- Supplied Collateral Caps: What should the max supply cap of aUSDT and aUSDC be?

- Minimum Acceptable Yield: What minimum yield should Ethena accept relative to the risk associated with both USDC & USDT markets on Aave?

While ethaUSDC and ethaUSDT are some of the most liquid markets on Aave and return meaningful yield, the return from supplied capital is relative to the utilization rate of these markets, and so too is the redemption risk. As yield grows, available exit liquidity decreases. The inverse relationship of yield and available exit liquidity is backdropped by token-specific risk (peg stability), market insolvency (bad debt), and governance risk. Due to the inverse relationship between yield and available exit liquidity—compounded by token-specific, insolvency, and governance risks—ethaUSDC and ethaUSDT positions on Aave must be actively managed to balance risk-reward relative to risk-minimized or risk-free rates.

Yield Analysis

Question: Do the yields for both USDC & USDT markets on Aave regularly underperform, track, or overperform current sUSDS / US3M rates?

-

Null hypothesis: Excluding outliers, the median yields for both USDC & USDT assets regularly fall in line or below current sUSDS/treasury rates thanks to moderate utilization ratios

-

Alternative hypothesis: Excluding outliers, the median yields for both USDC & USDT assets regularly outperform sUSDS/treasury rates thanks to increased utilization ratios

Overall: After removing statistical outliers, the alternative hypothesis is rejected, and the null hypothesis is upheld. As a result, Ethena should pursue active management of ethaUSDT and ethaUSDC based on the minimum required yield and available exit liquidity.

Methodology Details

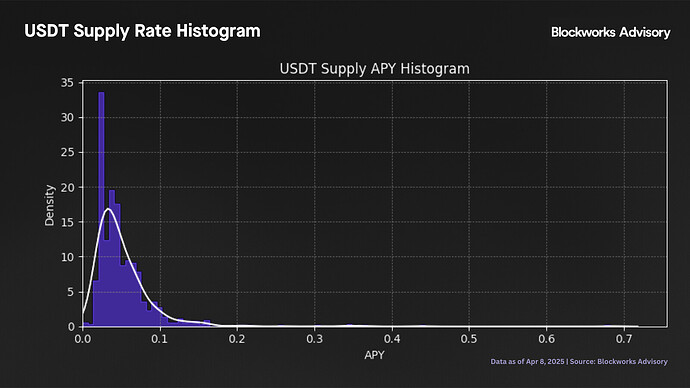

Defining Statistical Outlier: We excluded any data points that deviated more than 1.5 times the interquantile range, i.e. below Q1 − 1.5 × IQR and above Q3 + 1.5 × IQR from the full time series. We applied this statistical filter to the supply APY data to reduce the impact of outliers and better reflect the underlying trend in supply APY conditions.

Additional Information: The IQR method helps identify and remove extreme outliers by using the middle spread of the data, ensuring that the analysis is less skewed by unusually high or low values that don’t reflect typical market conditions. The resulting dataset, “USDT Filtered vs Raw Supply APY Over Time”, retains the core structure of the original while improving interpretability for downstream analysis. The IQR filter removes the following percentage of data points for USDC (7%) and USDT (5%) from the full data set.

USDT Utilization Rate & Filtered Data

Overall: The first-of-its-kind spike in utilization for the USDT market created a temporary liquidity crunch, causing the associated lending and borrowing rates to surge well above historical norms and marking Q4 2024 as a distinct statistical anomaly in the overall dataset.

USDT Utilization Rate

- Record High Utilization: In November 2024, USDT utilization hit a record high of 95.71%

- Trailing Utilization Rate: The trailing 6-month average USDT utilization rate is 77.97% and the trailing 12-month average USDT utilization rate is 78.61%

- Logical Conclusion: The utilization rates exhibited in November 2024 for USDT are statistical outliers

USDT Filtered vs Raw Supply APY

- Raw APY (Grey) In November Is An Outlier: The supply APY in November 2024 is visually a statistical outlier relative to every point in time except the beginning of the USDT market on Aave V3

- Logical Conclusion: To observe the regular supply APY of the USDT market, material deviations from the mean should be removed, and a filtered supply APY should be used (red).

USDC Utilization Rate & Filtered Data

Overall: The unprecedented surge in USDC market utilization led to a temporary liquidity crunch, driving lending and borrowing rates to climb sharply beyond historical averages and distinguishing Q4 2024 as a notable statistical outlier in the overall dataset.

USDC Utilization Rate

- Record High Utilization: In November 2024, USDC utilization hit an unprecedented high of 99.74%

- Trailing Utilization Rate: The trailing 6-month average USDT utilization rate is 81.53%, and the trailing 12-month average USDT utilization rate is 82.88%

- Logical Conclusion: The utilization rates exhibited in November and December 2024 for USDC are statistical outliers

USDC Filtered vs Raw Supply APY

- Raw APY (Grey) From October ‘24 To January ‘25 Is An Outlier: The supply APY from October 2024 to January 2025 is visually a statistical outlier relative to every point in time since the beginning of the USDC market on Aave V3

- Logical Conclusion: To observe the regular supply APY of the USDC market, material deviations from the mean should be removed, and a filtered supply APY should be used (red).

Supply APY Distribution & Extreme Outlier Analysis

Including Outliers: Supply APY Distribution & Extreme Outlier Analysis

Analysis and Charts

Overall: Before excluding outliers, data reveals that both USDT and USDC show much lower mean, median, and standard deviations when considering data since 2023 than 6-month figures. Additionally, USDT exhibits better capture of extreme APY events due to its relatively higher kurtosis; the most recent six months of supply APY are statistically uncharacteristic for both tokens, and USDC’s median supply APY does not materially outperform either the risk-minimized or risk-free rates.

Distribution Since Aave v3 USDT Genesis:

- USDT Higher Risk Premium Than USDC: Both Borrow APR and Supply APY for USDT distributions exhibit less uniformity than USDC, possibly signaling greater volatility or/and a higher risk premium in USDT markets on Aave.

Summary Statistics Since Aave v3 USDT/USDC Market (Genesis):

Summary Statistics USDT/USDC Market (6-Month):

Summary Statistic Analysis:

- Evaluating 6-Month Summary In Isolation: Taking the 6-month summary statistics in isolation would lead to the conclusion that both USDT – mean 6.1% and median 4.5% – and USDC – mean 14.2% and median 7.12% – offer higher average/median yields than the risk-minimized sUSDS rate (4.5%) and the US3M (4.4%). It would also cause the observer to believe that the volatility of USDC supply APY is substantially higher than that of USDT supply APY, and the relatively low kurtosis of USDC signals USDT captures better extreme APY events. The conclusion would be that reallocating a portion from the sUSDS allocated backing ($1.3B) to aUSDT and aUSDC could increase expected returns.

- Evaluating Both Summary Statistic Periods: Zooming out from the 6-month summary statistic to the genesis statistics, it is self-evident that the regular supply APY mean (USDT: 5.2% USDC: 7.5%), median (USDT: 4.2% USDC: 4.8%), stdev (USDT: 4.5% USDC: 9.1%) are much lower. Upholding the 6-month summary statistics, the relatively low kurtosis of USDC indeed signals USDT captures better extreme APY events.

- Logical Conclusion: Even before removing the extreme outliers from the supply APY of both USDT and USDC markets, the overall picture shows that the previous six months of supply APY were statistically uncharacteristic of both. Furthermore, the median supply APY of USDC is below the risk-minimized (4.50%) and risk-free rate (4.41%). While the averages are higher, they are driven by infrequent spikes and not consistent outperformance, indicating the median is a more consistent measure.

Excluding Outliers: Supply APY Distribution & Extreme Outlier Analysis

Analysis and Charts

Overall: After removing statistical outliers, USDC consistently outperforms USDT with an average APY of 5.2% compared to 4.5%, though both averages hover around the sUSDS benchmark (4.5%). The median analysis reinforces this stability, showing that USDC’s median yield (4.47%) nearly meets risk-free benchmarks, while USDT’s median (4.03%) falls short. Though it is true that USDC’s mean remains notably higher than benchmark rates by about 159bps, the median yields for both assets generally align with or fall below risk-minimized rates, indicating that passive holding would not yield additional benefits. Consequently, these insights suggest Ethena should adopt an active management strategy rather than a passive holding approach to maximize risk-to-return relative to benchmark.

All-Time Supply APY Distribution Comparison:

- Including outliers: both USDT and USDC supply rates mostly cluster in the low single-digit APY range. USDT exhibits narrower distribution with higher infrequent supply APYs, displaying less day-to-day variation.

- Excluding outliers: while both USDT and USDC supply APYs on Aave cluster in roughly the same range, USDC has a slightly broader distribution with higher potential yields toward the upper end.

Summary Statistics Since Aave v3 USDT/USDC Market (Genesis) (Ex\ Outliers):

Summary Statistics USDT/USDC Market (6-Month) (Ex\ Outliers):

Sidenote: USDC and USDT filtered supply APY was used to produce the visualized summary statistics.

Summary Statistic Analysis:

- USDC APY Leads USDT: After removing statistical outliers, USDC (5.18%) maintains a stronger average yield than USDT (4.52%). Both rates hover near or slightly above the sUSDS benchmark of 4.5%, yet they remain noticeably lower than previous summary figures — with mean supply APYs since genesis at 5.2% for USDT and for 7.3% USDC and fall even further beneath the six-month averages of 7.4% for USDT and 14.2% for USDC.

- USDC Median Yield Stays Near Benchmarks: The median APY for USDT (4.0%) is short of the benchmark risk-minimized yield (4.5%) and risk-free yield (4.41%), while USDC (4.5%) nearly matches it.

- Medians Lag Risk-Free Rates: When excluding statistical outliers, it is apparent that median supply APY from genesis (USDT: 4.0% USDC: 4.5%) and the previous six months (USDT: 4.5% USDC: 4.7%) have not materially outperformed the risk-minimized sUSDS rate (4.5%) and the risk-free US3M (4.41%). Notably, this conclusion does change when looking at the mean for USDT (5.17%) and USDC (6.09%), which is 69bps and 159bps above the risk-minimized rate. However, it is thought that the utilization rates for both markets during the previous six-month period were uncharacteristic and non-recurring.

- Passive Holding Isn’t Justified—Active Strategy Needed. Based on the all-time and six month median, we can state confidently that Ethena would not want to hold these assets passively because they would not regularly outperform the risk-minimized and risk-free rate. As a result, the alternative hypothesis is rejected, and the null hypothesis is upheld. Excluding outliers, the median yields for both USDC & USDT assets regularly fall in line or below current sUSDS/treasury rates thanks to moderate utilization ratios. Instead of passively holding, Ethena should pursue active management. Additionally, Ethena’s portion of aUSDT or aUSDC will inevitably also have an impact on borrowing dynamics, especially if it adds up to a large percentage of total supply. While extra supply is expected to lower yield in the short-term, medium to long term a deeper liquidity can attract more consistent heavy borrowing, changing the analyzed dynamic.

Peg Stability

Overall: The primary defense against these risks is to limit the exposure to assets that could potentially suffer from peg instability. By capping the allocation to Aave’s aUSDC and aUSDT at a level that reduces systemic interdependency, Ethena can minimize the adverse effects of any sudden liquidity crisis or depegging event.

Question - Token-Specific Risk: How does peg stability of USDC & USDT affect supplying collateral to those markets on Aave?

USDC and USDT aim to hold a 1:1 parity with the U.S. dollar, but temporary depeggings can and have occurred before. When the peg deviates, confidence in the stablecoin weakens, market liquidity diminishes, and unexpected losses may occur for Aave lenders holding aUSDC or aUSDT. Specifically, if redemptions or conversions become less reliable:

- Increased Borrowing Costs and Volatility: Temporary depegging can lead to sharper swings in collateral values, utilization rates, and escalate borrowing costs, exposing both lenders and borrowers to sudden market shifts.

- Systemic Risk Amplification: A deviation undermines the overall stability of the protocol and may trigger a cascade of defensive actions, further destabilizing the market.

Even though USDC, USDT, and other similar tokens have a strong track record of stability, it is prudent to consider extreme scenarios for a complete analysis of risk. For instance, in March 2023, USDC de-pegged for a few hours in the wake of the Silicon Valley Bank collapse, inciting market panic. In a scenario like this it is possible that:

- Many Aave depositors rush to withdraw USDC to avoid exposure,

- Speculators aggressively borrow USDC to short the asset,

- Utilization rates spike to extreme levels (approaching 100%), and

- New deposits almost completely disappear, leaving Aave with virtually zero withdrawable USDC until the situation stabilizes.

In such a stressed environment, if Ethena acts as a major supplier of these assets, it risks being unable to withdraw a substantial portion of its holdings precisely when it is most needed. This creates a scenario where extreme market events not only disrupt the peg but also freeze liquidity within the Aave ecosystem. It is paramount for Ethena to avoid this. To do so, Ethena must limit how much capital is at risk and how exposed it is to external events or market panic.

Redemption Risks Of aTOKENs

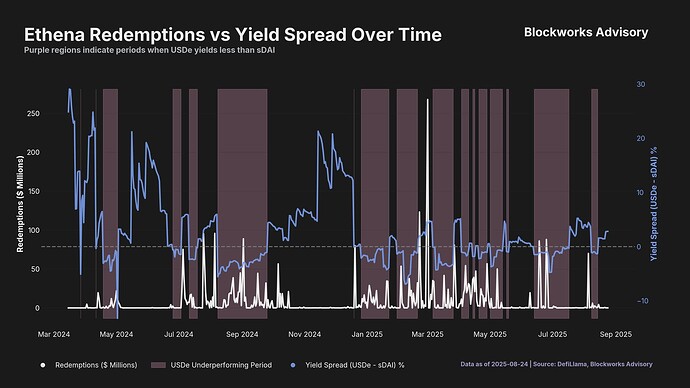

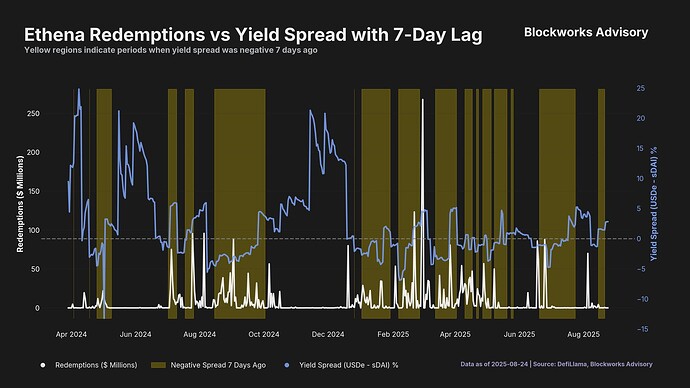

Overall: When utilization rate is high, supply APY becomes very volatile, and exit liquidity diminishes. Ethena should mitigate its exposure to capturing outlier supply APY because it corresponds with increased redemption risk and, thereby, elevated exposure to depeg scenarios. To capture the greatest yield with the minimum risk, the amount of capital supplied should be based on available exit liquidity and the minimum required return relative to benchmark.

Question: What risk is associated with redemption requests for USDC & USDT markets on Aave?

Background On aTOKEN Redemption Process

Within the Aave protocol, aTokens are issued on a one-to-one basis with their underlying assets—depositing 1 USDC yields 1 aUSDC, which can later be redeemed for your original USDC plus accrued interest. The value of these aTokens is maintained at a 1:1 ratio with the corresponding supplied asset, and yield is continuously credited by tracking changes in the liquidity index between deposit and withdrawal. The redemption risk here refers to the possibility that, when you withdraw, the protocol may not be able to fully convert your aTokens back into the underlying asset. This risk is not a matter of legal perfection or priority but is instead determined by the market’s available liquidity, protocol’s solvency, and the security of its governance mechanisms.

USDT Exit Liquidity:

- Record Lows For Exit Liquidity: During November 2024 utilization rates hit their highest level ever at 95.71%, dropping available exit liquidity to around $200m for the period and to 4.29% of total supplied capital.

- Comparing Exit Liquidity Across USDT & USDT: Perhaps the reason for higher available liquidity of USDT relative to USDC was that slope 2 for USDT was set to 100% versus USDC’s slope 2 of 60% (Source).

- Logical Conclusion: Extremely high utilization rates lead to elevated supply APY periods, while simultaneously reducing the liquidity cushion for suppliers, demonstrating an inverse relationship between yield and exit liquidity.

USDC Exit Liquidity:

- Record Highs For Utilization Rate: From October to December 2024 utilization rates hit an all-time high of 99.74%, reducing available exit liquidity to around $50m for the period and to 2.75% of total supplied capital.

- Aave Increases The Cost Of Borrowing: In response to both record utilization levels, on 12/15/24 Aave DAO increased slope 1 for all stablecoin assets to raise the cost of borrowing under Uoptimal and decreased slope 2 for all stablecoin assets (except USDT, USDC, and DAI) to lower the cost of borrowing over Uoptimal. Later in February of 2025 Aave DAO decreased borrow slope 1 for all stablecoin assets – still remaining above the slope 1 rates before the 12/15/24 raise.

- Logical Conclusion: The increase to borrowing costs in response to increased utilization suggests that supply was not increasing at a faster rate than borrowing demand and action needed to be taken. USDC high utilization rates boosted supply APYs but reduced the liquidity cushion, displaying an inverse relationship between yield and exit liquidity.

It’s also important to zoom in on how Aave’s utilization ratio and available liquidity have historically behaved during periods when the supply APY was above the benchmark, as these are the scenarios most relevant to Ethena. For USDC, the supply APY exceeded 4.75% on 370 out of 786 days (47.07%), and for USDT, on 308 days (39.19%). Below, we show how utilization and exit liquidity were distributed during those periods. While Ethena’s participation would likely improve liquidity conditions somewhat, historically, available liquidity for withdrawals has mostly stayed below $200M, with utilization consistently high around 90%.

Risk Of Bad Debt

Overall: A new system to cover bad debt (Umbrella), paired with the past precedent of Aave DAO acting as the lender of last resort ($100m in treasury) suggests that impactful bad debt is a low probability.

Question: What is the risk of bad debt in USDT & USDC markets on Aave?

Time and again Aave DAO has historically been the Lender Of Last Resort (LOLR) with Marc Zeller stating, “The few excess debt events in Aave protocol history have been addressed by governance through the mobilization of “cash” DAO treasury funds” (Aavenomics TEMP CHECK). This past precedent implicitly affirms that Aave DAO is willing and able to clear bad debt.

Furthermore with the addition of Umbrella (a new integration on Aave that enables users to stake aTokens and earn rewards by taking on the responsibility of covering bad debt) the risks of bad debt accruing to Aave DAO are further reduced.

Risk Of Governance Influence

Overall: Since protocol emergency admin functions are reasonably scoped and members of the Guardian Committee are doxed, the risk of negative governance influence on lending positions is minimal.

Question: By supplying liquidity on Aave to USDC & USDT markets what are the risks incurred by Aave DAO?

The three primary admin function by which Aave DAO can pose a risk to lenders/supplied of any market are:

- Emergency Admin: are a member of the guardian multisigs, one, is a failsafe emergency actor for cross-chain messaging in Emergency Mode, and, two, is able to “veto” an onchain payload if it is deemed malicious

- Risk Admin: manage protocol risk parameters through verified on-chain processes and pool admin functions.

- Pool Admin: Used Aave protocol V3’s new PoolConfigurator contract to enable or disable assets in isolation mode, set debt ceilings, adjust supply and borrow caps, modify liquidation fees, create new eMode categories, and update various protocol fees.

Emergency Voting Mechanisms (Guardian Committee): Emergency Voting Mechanisms, particularly the Guardian multisig, serve as a critical safeguard against takeover attempts of the Aave Protocol. By allowing a 5-of-9 multisig veto to cancel malicious proposals or pause/unpause important functions, the Guardian provides a last-resort defense to protect the protocol and its users—especially when a large amount of AAVE resides on centralized exchanges.

Protocol Emergency Guardian:

- Chaos Labs (risk service provider).

- Llamarisk (risk service provider).

- Karpatkey (finance service provider).

- Certora (security service provider).

- Tokenlogic (finance service provider).

- BGD Labs (development service provider).

- ACI (growth and business development service provider)

- Ezr3al (Aave DAO delegate).

- Stable Labs (Aave DAO delegate).

Governance Emergency Guardian:

- Seb (Zapper)

- Mounir (Paraswap)

- Gavi Galloway (Standard Crypto)

- Nenad (Defi Saver)

- Fernando (Balancer)

- Roger (Chainlink community)

- Mariano Conti (DeFi OG)

- Marin (Lido)

- Certora (security service provider)

Expected Returns Based On Supply Cap

Overall: Even under reasonable bull utilization levels of 85% for USDT and 89% for USDC, the expected supply APY is 3.82% and 4.12%, respectively. It is not until utilization rates are above optimal that USDT and USDC markets on Aave outperform the risk-minimized sUSDS rate (4.5%) and risk-free (4.4%). In times of low utilization, the opportunity cost of capital to allocate to either market increases while capital efficiency decreases relative to benchmark.

Question: What are the expected returns for supplying capital to USDC & USDT markets in a bear and bull scenario on Aave?

Bear Case

USDT Calculations

- Current Supply $3,369,617,651

- Current Borrowed $1,884,586,986

- Current UR: 55.93%

- Current Supply APY: 1.83%

- Current Borrow APR: 3.65%

- 30% Proposed max supply: $1,444,121,850

- 15% Proposed max supply: $594,638,409

- 5% Proposed max supply: $177,348,297

The average difference between the Borrow APR and Supply APY, excluding outliers using the filtered APY is 1.72%. We’re currently at the lowest utilization levels for each market since their genesis, indicating we’re in a bear scenario.

Assuming the full allocation is made today, the reserve factor is constant, and the borrowed amount remains the same, the pool’s supply APY would decrease by:

- 30% Proposed max supply:

- Total Supply = (Supplied + Proposed max supply)

- $4,813,739,501 = $3,369,617,651 + $1,444,121,850

- Projected_UR = 39.14% = $1,884,586,986 / $4,813,739,501

- Borrow APR with current curve: 2.54%

- Projected Supply APY = 0.82%

- Projected Decrease = 1.01%

- 15% Proposed max supply:

- Total Supply = (Supplied + Proposed max supply)

- $3,964,256,060 = $3,369,617,651 + $594,638,409

- Projected_UR = 47.53% = $1,884,586,986 / $3,964,256,060

- Borrow APR with current curve: 3.10%

- Projected Supply APY = 1.38%

- Projected Decrease = 0.45%

- 5% Proposed max supply:

- Total Supply = (Supplied + Proposed max supply)

- $3,546,965,948 = $3,369,617,651 + $177,348,297

- Projected_UR = 53.13% = $1,884,586,986 / $3,546,965,948

- Borrow APR with current curve: 3.46%

- Projected Supply APY = 1.74%

- Projected Decrease = 0.09%

USDC Calculations

- Current Supply $2,689,001,558

- Current Borrowed $1,786,314,057

- Current UR: 66.43%

- Current Supply APY: 2.59%

- Current Borrow APR: 4.30%

- 30% Proposed max supply: $1,152,429,239

- 15% Proposed max supply: $474,529,686

- 5% Proposed max supply: $141,526,397

The average difference between the Borrow APR and Supply APY, excluding outliers using the filtered APY is 1.61%

Assuming the reserve factor and borrowed amount remain constant the pools supply APY would decrease by:

-

30% Proposed max supply:

- Total Supply = (Supplied + Proposed max supply)

- $3,841,430,797 = $2,689,001,558 + $1,152,429,239

- Projected_UR = 46.50% = $1,786,314,057 / $3,841,430,797

- Borrow APR with current curve: 1.42%

- Projected Supply APY = 1.31%

- Projected Decrease = 1.28%

-

15% Proposed max supply:

- Total Supply = (Supplied + Proposed max supply)

- $3,163,531,244 = $2,689,001,558 + $474,529,686

- Projected_UR = 56.45% = $1,786,314,057 / $3,163,531,244

- Borrow APR with current curve: 3.68%

- Projected Supply APY = 2.01%

- Projected Decrease = 0.58%

-

5% Proposed max supply:

-

Total Supply = (Supplied + Proposed max supply)

- $2,830,527,955 = $2,689,001,558 + $141,526,397

-

Projected_UR = 63.11% = $1,786,314,057 / $2,830,527,955

-

Borrow APR with current curve: 4.14%

-

Projected Supply APY = 2.52%

-

Projected Decrease = 0.07%

Bull Case

USDT Calculations

The trailing 6-month average USDT utilization rate is 77.97% and the trailing 12-month average USDT utilization rate is 78.61%. A bull scenario could lead to a utilization of 85% which would be an increase of 55% from current levels.

The average difference between the Borrow APR and Supply APY, excluding outliers using the filtered APY is 1.72%

Assuming the full allocation is made today, the reserve factor is constant, and the borrowed amount increases to match average utilization levels, the pool’s supply APY would increase by:

- Projected Supply APY With AVG UR:

- Projected_UR = 85%

- Borrow APR with current curve: 5.54%

- Projected Supply APY = 3.82%

USDC Calculations

The trailing 6-month average USDT utilization rate is 81.53%, and the trailing 12-month average USDT utilization rate is 82.88% USDC. A bull scenario could lead to a utilization of 89%, which would be an increase of 27%.

The average difference between the Borrow APR and Supply APY, excluding outliers using the filtered APY is 1.61%

Assuming the full allocation is made today, the reserve factor is constant, and the borrowed amount increases to match average utilization levels, the pool’s supply APY would increase by:

- Projected Supply APY With AVG UR:

- Projected_UR = 89%

- Borrow APR with current curve: 5.80%

- Projected Supply APY = 4.19%

Recommended Supply Cap & Required Minimum Yield

Overall: Ethena should cap the amount of aUSDT to aUSDC supplied between or at 5-10% of total supply to account for the inverse relationship between yield and available exit liquidity, token-specific risks, insolvency risks, and governance risks. The position should be actively managed because – as displayed by the Yield Analysis section – passively managed positions do not accurately balance the risk-reward relative to risk-minimized or risk-free rates. By requiring that the supplied capital to either market accrue a minimum 25bps premium on top of benchmark and the exit liquidity remains above 1.25x(supplied capital), Ethena accrues outsized returns for reasonable risks.

Questions

Supplied Collateral Caps: What should the max supply cap of aUSDT and aUSDC be?

For other venues where Ethena deploys capital, the Risk Committee has established a soft 10% cap on exchange open interest per asset backing USDe. This cap is applied differently depending on the venue type: when opening perpetuals positions, the cap is based on the share of open interest Ethena contributes; when deploying capital to lending platforms, it should be based on the share of total supply Ethena contributes. In this case, when utilizing Aave or similar lending protocols, Ethena should use the cap relative to the total borrowable supply, aligning with its role as a lender in the system.

Given the redemption, token-specific, insolvency, and governance risks, Ethena should not account for more than 5%-10% of the combined aTOKEN total supply of USDC and USDT markets. Presently, the combined aTOKEN total supply of both markets is $6,060,000,000, resulting in a maximum allocation of $303,000,000 for a 5% cap. Assuming the 5% cap was reached, aUSDT and aUSDC backing collateral would comprise 7.87% of the Liquid Stables category at the time of writing – enhancing diversification.

Minimum Acceptable Yield: What minimum yield should Ethena accept relative to the risk associated with both USDC & USDT markets on Aave?

It is not until utilization rates are above optimal that USDT and USDC markets on Aave outperform the risk-minimized sUSDS rate (4.5%) and risk-free (4.4%). In an environment where both markets are at their optimal utilization rate — USDT uOptimal (92%) USDC uOptimal (92%) — demand for borrowing is higher than average. To expose Ethena to the yield from utilization rates increasing past optimal levels it should consider allocating capital just before the optimal utilization rate is met.

For all the risk incurred by allocating to both markets, a minimum 25bps improvement on the MAX(risk-minimized, risk-free) yield should be considered; to achieve the maximum yield, Ethena could dynamically adjust to whichever market has a higher supply APY. Balancing value extraction with redemption risk is key. Ethena should consider removing deployed capital from the market when 1.25x(supplied capital) remains in available exit liquidity in that specific market.

Notably, if Ethena’s supply cap were higher, it would increase the exposure to all formerly detailed risks but also heavily reduce the utilization ratio when supplying capital at or slightly before uOptimal for both markets. As a result, the supply APY would drop below the minimum required return previously outlined and borrowing demand would need to meet the outsized allocation to return to uOptimal levels. Keeping the supply cap at a small percentage of the total supply of both markets makes this scenario unlikely.