Ethena: November 2025 Governance Update

Prepared by Kairos Research

1. Overview

This report summarizes key governance, risk, and ecosystem developments for the Ethena protocol during November 2025.

The month was defined by continued market turbulence, coupled with early indications of high demand for new product lines.

2. Key Takeaways

-

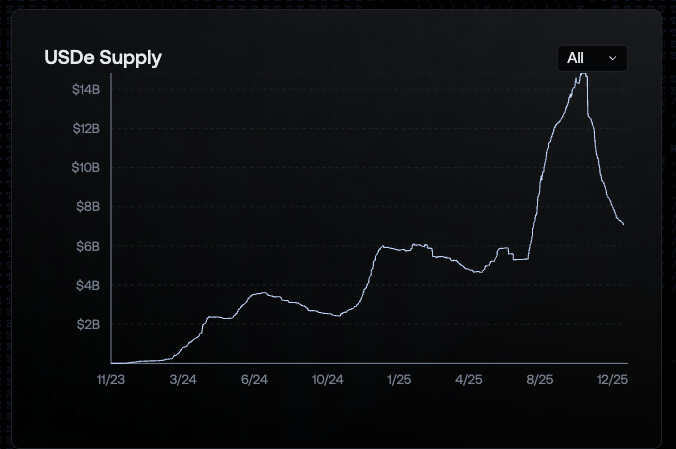

USDe supply contracted materially (~$2.26bn) as November’s market volatility, Pendle maturities, and exchange outflows drove elevated redemptions. BTC declined ~20% over November.

-

System health remained resilient, with the backing ratio consistently above 100% and reserve balances stable despite market stress.

-

sUSDe yield remained competitive (4.7- 4.8% APY).

-

Risk Committee approved a new emergency discount-purchase & burn mechanism, strengthening USDe’s ability to defend the peg during severe dislocations (<0.99).

-

Institutional and ecosystem traction accelerated, including major developments with Robinhood, Hyperliquid Unit, Reya, and Nunchi, expanding USDe’s distribution and utility.

-

Stablecoin-as-a-service demand proved extremely strong, highlighted by MegaETH’s pre-deposit contract attracting $500m USDC even before launch, indicating meaningful future revenue diversification beyond USDe alone.

-

sUSDe liquidity reached all-time highs, while USDe DEX liquidity retraced

3. Protocol Metrics & System Health

USDe Supply

-

Starting supply: $9.43bn

-

Ending supply: $7.17bn

-

Net monthly change: ($2.26bn)

-

Drivers of change (minting/redemptions, demand surges, market conditions): Primary drivers of change can be attributed to market conditions, plus the maturity of the Nov-26th USDe and sUSDE Pendle markets.

sUSDe Yield

- Average APY: 4.77%

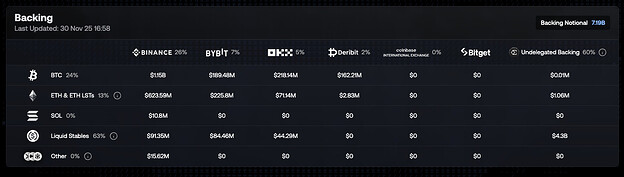

Backing & Reserves

-

Backing ratio: 100.91%

-

Reserve Fund balance: $62m

-

Changes to the composition of collateral or hedging instruments:

Stress & Stability Metrics

USDe traded in a tight band of $0.998 - $1.002 for most of the month, despite large redemptions and Pendle maturities.

4. Risk Committee & Governance Activity

Risk Committee Decisions

-

The Risk Committee approved a proposal from Ethena Labs Research for a mechanism which will allow for the Ethena protocol to have the ability to purchase discounted USDe on secondary markets using backing assets, which will be immediately burned following trade settlement. The mechanism is intended only to be used in severe market dislocations, as defined by USDe price trading below 0.99, and an ad hoc Proof of Reserve will be provided within 24 hours of this mechanism being utilized.

-

The passing of this new mechanism comes at a time when the amount of USDe on exchanges has been in a downward trend

Transparency & Audits

- The November Custodian Attestation: https://paragraph.com/@ethena-labs/custodian-attestations-of-assets-backing-usde-november-1

5. Ecosystem Integrations & Institutional Developments

Exchanges & Liquidity

Listings/expansions on centralized exchanges:

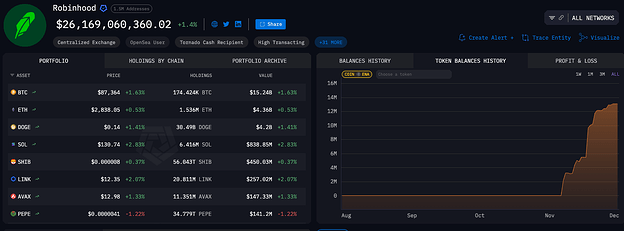

- ENA was listed on Robinhood on November 6th, with approximately 13m ENA now sitting on the exchange.

-

ENA also went live on Hyperliquid spot via Unit, it has done over $68m in volume since.

-

A partnership announcement with Reya stated that all assets in their LP pool will be held entirely in Ethena’s USDe/sUSDe. The platform has done around 19bn in volume, with $31m of TVL using data from DeFi Llama.

-

Ethena also announced it will partner with HIP-3 deployer Nunchi, who plans to deploy pepetuals on yield markets, allowing users to express views on RWA rates, dividends, ETH staking yield, etc. Nunchi will launch all of its initial markets with USDe as the quote asset, and will also incentive the initial bootstrapping of Nunchi’s nHYPE with 20x Ethena rewards.

-

Terminal Finance announced it will not be launching as planned.

-

USDe quote markets were announced for spot HYPE and various HIP-3 markets

Liquidity improvements on DEXs:

-

DEX liquidity for USDe fell roughly $21m during the month of November

-

Meanwhile, DEX liquidity for sUSDe rose to an all time high of $248m, roughly a $9m increase over the month of November. The Fluid sUSDe-USDT pool remains the largest with $104m of total liquidity, approximately $46m of that is USDT.

Stablecoin as a Service Adoption

- Stablecoin-as-a-service deployments (e.g., USDm / white-label stablecoins): MegaETH’s pre-deposit bridge opened up on November 20th with an anticipated cap of $250m. However, following some unforeseen incidents they decided to refund all depositors given “sloppy execution” on the MegaETH team’s behalf. Despite the chaos, $500m USDC was deposited to the pre-deposit contract, providing a glimpse of just how fast some white label solutions from Ethena can, and will likely in our opinion, grow.

This will likely result in a strong protocol revenue diversifier away from just USDe, with interest from USDtb.

6. DeFi Activity & On-Chain Behavior

Lending & Collateral

- USDe/sUSDe usage in lending markets:

Plasma Instance:

PT sUSDe January 2026: $641.15m of $800m cap (80%)

PT USDe January 2026: $127m of $400m cap (31%)

USDe: $217m of $1.75bn supply cap (12.4%) | $96.12 of $400m borrow cap (24.03%)

sUSDe: $396m of $1.58bn supply cap (25.06%)

Ethereum Core Instance:

PT USDe February 2026: $71.66m of $120m supply cap (59%)

PT sUSDe February 2026: $120m of $120m supply cap (100%)

USDe: $871m of $2.7bn supply cap (32.26%) | $339.82 of $2.5bn borrow cap (13.59%)

sUSDe: $991m of $1.7bn supply cap (58.29%)

Utilization of USDe on Aave has continued to fall on Ethereum mainnet’s core instance, while it has shown signs of recovery on Plasma’s.